How to Get an IDNYC Card

Above is an example of an IDNYC identification card.

Access to health care is an essential need, but for immigrants in the United States, navigating the health insurance landscape can be complex. Eligibility and access vary depending on immigration status, state of residence, income level, employment, and family composition.

Right to care

All people have a right to receive medical care regardless of immigration status or health insurance coverage. Doctors, hospitals, and other healthcare providers may inquire about your immigration status or insurance coverage, but they cannot deny you emergency medical care for lack of documentation or ability to pay. Texas and Florida require hospitals to ask patients about their immigration status, though you are not obligated to provide immigration-related information and they cannot withhold care because of your status or your refusal to disclose it.

Coverage options

The health insurance options available to you depend heavily on your immigration status and income. Most lawfully present immigrants are eligible for health insurance coverage under Medicaid, the Children’s Health Insurance Program (CHIP), emergency Medicaid, Marketplace health insurance, or employer-sponsored and individual coverage private health insurance. Lawfully present immigrants include qualified non-citizens, asylees, refugees, temporary legal residents, and holders of non-immigrant visas.

Medicaid

Medicaid is a joint federal and state program that, together with CHIP, provides free and low-cost public health insurance to over 77.9 million Americans, mostly individuals between the ages of 19 and 64 earning low incomes along with children, pregnant women, parents, seniors, and those with disabilities. Medicaid is the single largest source of health coverage in the United States. Eligibility criteria vary between states, though minimum coverage standards are set by federal law and apply to all state programs.

Eligibility

Generally, to qualify for Medicaid coverage as an immigrant, you must be a qualified non-citizen between the ages of 19 and 64. Applicants with certain immigration statuses are only eligible to receive Medicaid after they’ve legally resided in the United States for at least five years since receiving qualified non-citizen status. You must also be a resident of the state from which you receive Medicaid. Qualified non-citizens include:

Eligible after five-year waiting period

Lawful Permanent Residents (LPR/Green Card Holder)

Paroled into the U.S. for at least one year

Conditional entrant granted before 1980

Battered non-citizens, spouses, children, or parents

Eligible, exempt from five-year waiting period

Asylees

Refugees

Cuban/Haitian entrants

Victims of trafficking and his or her spouse, child, sibling, or parent or individuals with a pending application for a victim of trafficking visa

Granted withholding of deportation

Member of a federally recognized Indian tribe or American Indian born in Canada

Citizens of the Marshall Islands, Micronesia, and Palau who are living in one of the U.S. states or territories (referred to as Compact of Free Association or COFA migrants)

Veterans or active-duty military and their spouses or unmarried dependents who also have “qualified non-citizen” status

The five year waiting period for Medicaid and CHIP coverage eligibility may be waived in some states for pregnant qualified non-citizens and children who are lawfully residing in the United States.

In addition to legal immigration status, Medicaid eligibility is determined by your Modified Gross Adjusted Income (MAGI), a calculation of your gross monthly taxable income in proportion to the size of your household. You will typically qualify for Medicaid if your income is equal to or below a certain percentage of the federal poverty level ($1,304/month, $15,650/year for one person). Each state is allowed to set its own income threshold to qualify for coverage under its Medicaid program, but on average, your monthly income must be at or below 138% of the federal poverty level (about $1,800/month for one person) to receive Medicaid coverage. Non-taxable income—such as child support, workers compensation, Supplemental Security Income (SSI), and Social Security benefits—is not included in your MAGI calculation. Income criteria for Medicaid eligibility is waived if you are older than 64 years old, disabled, medically-needy, in foster care, dually eligible for Medicare coverage with Medicaid discounts applied, or a recipient of other need-based programs like the Supplemental Nutrition Assistance Program (SNAP) or Temporary Assistance for Needy Families (TANF). MAGI calculations and exemptions from income-based eligibility criteria are standardized across state Medicaid programs by federal law under the ACA.

Application

There is no single application for Medicaid and you can apply at any time. Application guidelines and requirements vary by state. Usually, you will need to provide the following information:

Your name and date of birth

Your Social Security number

Your monthly payment amounts for rent, mortgage, or utilities

Proof of citizenship or immigration status

Proof of income, like paystubs or W-2s

A verification of what other government benefits you receive

Information about an insurance plan your employer has offered you or an insurance plan you currently have

Medicaid applications usually require you to provide your Social Security number. If you do not have an SSN but are otherwise eligible to receive Medicaid, your state’s Medicaid agency is required to assist you in applying for one and it cannot withhold Medicaid coverage while your SSN application is pending. Non-citizens seeking access to entitlement programs like Medicaid can apply for an SSN. To apply for an SSN in pursuit of Medicaid coverage, you will need to provide proof of identity, citizenship, age, and your intent to apply for Medicaid.

Cost and coverage

Medicaid only covers healthcare services in the state where it is administered, though out-of-state emergency care is also covered. Not all medical providers accept Medicaid. To locate a Medicaid medical provider, check with your state's Medicaid agency. You can use Medicaid whenever you need and there is no limit on the amount of care you can receive. Most Medicaid recipients do not have to pay a monthly premium for coverage. However, some states may charge premiums or impose cost-sharing obligations on certain Medicaid recipients, meaning they must pay some money out-of-pocket for coverage. Out-of-pocket costs include co-insurance, co-payments, and deductibles. Medicaid out-of-pocket maximums vary by state, though total out-of-pocket costs cannot exceed 5% of a covered household’s annual income. Certain healthcare services and populations are universally exempt from Medicaid cost-sharing including emergency care, family planning services, prenatal care, and medical care for children, the terminally-ill, and institutionalized individuals.

Children’s Health Insurance Program (CHIP)

The Children’s Health Insurance Program (CHIP) provides free or low-cost health insurance coverage to children or pregnant women living in households which earn too much to qualify for Medicaid coverage but too little to reasonably afford private insurance. It is available in every state.

Eligibility

Each state program sets its own eligibility criteria for CHIP. If you apply to your state agency for Medicaid coverage, you’ll also find out if your children qualify for CHIP. CHIP and Medicaid have the same eligibility guidelines and five-year waiting period requirements in regard to immigration status.

Application

You can apply for CHIP at any time. CHIP applicants are usually required to provide their SSN. Like Medicaid, CHIP services cannot be withheld if you lack an SSN but meet all other qualifications for coverage, and your state’s CHIP agency is obligated to help you obtain an SSN.

Cost and coverage

Not all medical providers accept CHIP. To locate a CHIP medical provider check with your state's Medicaid agency. There is no limit on the amount of care you may receive with CHIP coverage. Some states charge a monthly premium for CHIP coverage and may impose cost-sharing obligations. Routine doctor and dental checkups are free under CHIP, but you may pay a co-pay for other services. Like Medicaid, total out-of-pocket costs cannot exceed 5% of a covered household’s annual income.

Emergency Medicaid

All states must provide emergency Medicaid coverage to non-citizens who would otherwise be eligible to receive full Medicaid benefits but are disqualified by their immigration status.

Application

You will need to contact your state’s Medicaid agency to apply for emergency coverage. Hospital staff can assist you with this. To apply, you must provide proof of identity and income. You will not need an SSN to apply. You will typically initiate your application while or shortly after receiving treatment. Some states accept retroactive applications submitted within a specific timeframe after receiving emergency care.

Cost and coverage

Emergency Medicaid only covers the cost of emergency medical care and coverage ends after the patient is stabilized.

Marketplace health insurance

The Health Insurance Marketplace managed by CMS and the marketplaces or exchanges operated by dozens of states expand access for consumers to purchase private health insurance policies with cost-saving benefits. All insurance plans sold on the Marketplace must comply with the standards for affordability, accessibility, and coverage mandated by the ACA. Insurers cannot exclude you from enrollment in Marketplace plans because of your age or pre-existing health conditions, nor can they terminate your insurance because of illness.

Eligibility

Any unincarcerated citizen or lawfully present immigrant living in the US or its territories who does not qualify for Medicare or Medicaid coverage may apply for Marketplace health insurance, regardless of income level. However, your employment and income will determine your eligibility to receive premium subsidies.

Application

The application process for Marketplace health insurance coverage varies between state exchanges and the federal Marketplace managed by CMS. Generally, you will need to provide proof of identity and immigration status, an SSN, proof of employment and employer contact information for every employed household member, an estimate of your annual income, and verification of your household’s income, and a summary of your existing health insurance coverage. You may need to provide any of the following documentation to verify your immigration status:

Permanent Resident Card, “Green Card” (I-551)

Reentry Permit (I-327)

Refugee Travel Document (I-571)

Employment Authorization Document (I-766)

Machine Readable Immigrant Visa (with temporary I-551 language)

Temporary I-551 Stamp (on passport or I-94/I-94A)

Arrival/Departure Record (I-94/I-94A)

Arrival/Departure Record in foreign passport (I-94)

Foreign Passport

Certificate of Eligibility for Nonimmigrant Student Status (I-20)

Certificate of Eligibility for Exchange Visitor Status (DS-2019)

Notice of Action (I-797)

Document indicating membership in a federally recognized Indian tribe or American Indian born in Canada

Certification from U.S. Department of Health and Human Services (HHS) Office of Refugee Resettlement (ORR)

Document indicating withholding of removal

Office of Refugee Resettlement (ORR) eligibility letter (if under 18)

Alien number (also called alien registration number or USCIS number) or I-94 number

USCIS Acknowledgement of Receipt (I-797C)

Plans

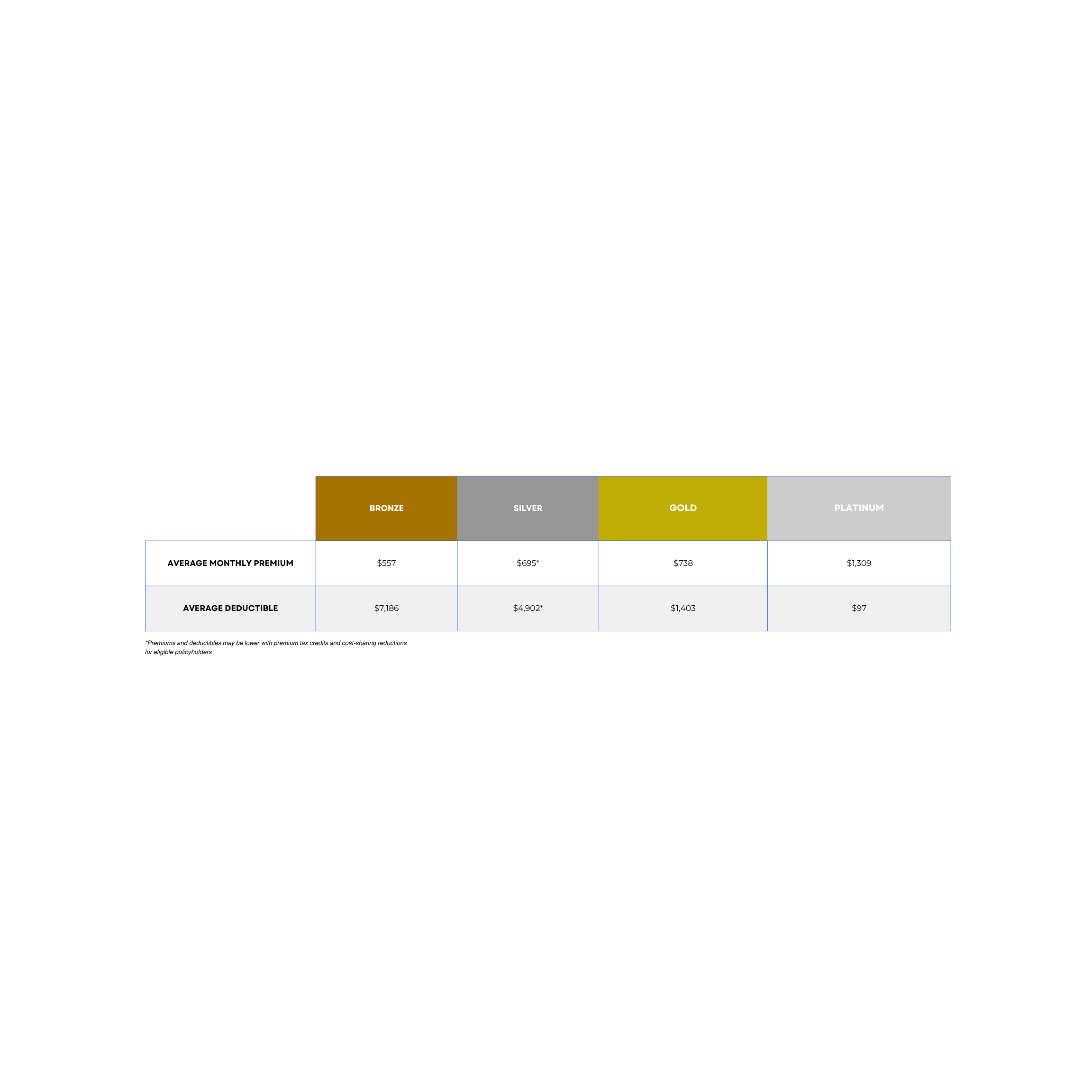

Health insurance plans sold on the Marketplace are organized in four tiers—bronze, silver, gold, and platinum—based on their division of premiums and out-of-pocket cost. Plans in the lower tiers offer coverage with cheaper monthly premiums but require patients to pay for a greater share of their medical expenses out-of-pocket, while higher-tier plans have more expensive monthly premiums with lower out-of-pocket costs. Below is a breakdown of the premiums and cost-sharing structures of plans from each Marketplace tier.

Cost and coverage

Marketplace policyholders are expected to contribute a certain percentage of their household income to the cost of their premium based on their income level. Households earning ≤150%, 200%, 250%, 300%, or 400% of the federal poverty level (FPL) are expected to contribute 0%, 2%, 4%, 6%, or 8.5% of their annual income, respectively. Policyholders with incomes equal to or below 400% of the FPL are eligible to receive subsidies for the cost of their premium in the form of refundable tax credits. Tax credits are calculated by subtracting the household’s expected contribution from the benchmark annual premium of the second-lowest cost silver plan (SCLSP). These subsidies effectively cap premiums as a share of the policyholder’s income between 0% and 8.5%. Through the end of 2025, Marketplace premium contributions are capped at 8.5% of any policyholder’s income, even if it exceeds 400% of the FPL.

You won’t qualify for Marketplace insurance with premium tax credit subsidies if your employer offers health benefits—even if you would be eligible for subsidies based on your income level—unless your employer’s plan falls short of minimum affordability and coverage standards determined by the ACA. Your family may receive subsidized Marketplace coverage if your employer’s family insurance plan is too expensive for your household to afford, even if individual coverage for just yourself would be affordable under their plan. The out-of-pocket maximums of all Marketplace plans are capped by the ACA and, currently, may not exceed $9,200 for individuals and $18,400 for families. Households that qualify for premium tax credits and earn between 100% and 250% of the FPL are entitled to cost-sharing reduction subsidies exclusive to silver plans including lower deductibles, co-insurance rates, and out-of-pocket maximums. These premium tax credits and cost-sharing reductions can make certain silver plans comparable to platinum plans.

Policies purchased from the Marketplace guarantee coverage for ten essential health benefits without annual or lifetime expense limits:

Ambulatory patient services

Emergency services

Hospitalization

Maternity and newborn care

Mental health and substance use disorder services

Prescription drugs

Rehabilitative and habilitative services and devices

Laboratory services

Preventive and wellness services and chronic disease management

Pediatric services, including oral and vision care

Free preventative care and continuing coverage for your children beyond the age of 18, among other benefits are also standardized by the ACA.